Bitcoin is back, baby.

For any seasoned hodler, it’s laughable to suggest it’d stay gone. My feeling: the longer it stays “dead,” the better. But, the era of cheap sats seems to be over.

There is simply too much bullishness for the price to stay tamped down:

ETF approvals imminent

The halving is months away

The Fed is positioning to loosen up monetary policy (money printer about to go brrrr)

The shitshow that will be the 2024 presidential election (loose monetary policy the current administration will push for)

All of these things may not even matter because bitcoin is novel NgU technology. We are but mere witnesses to the total demonetization of all other assets in bitcoin terms. (Yes, I’m feeling bullish.)

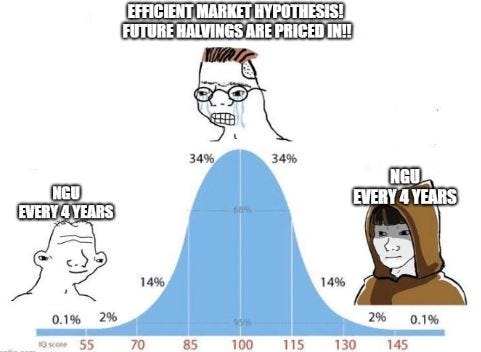

I very well could be on the left end of this bell curve, but I see no reason to abandon the simple framework of: Number go Up every 4 years.

That’s where the Bitcoin Glidepath comes in. If I orient my thought process around bull markets taking place every 4 years, I can position my life energy accordingly. 2025, 2029, 2033, I’m looking at you.

I’m going to share my personal playbook, partly to hold myself accountable to actually stick to it, and also in the off-chance that it might be helpful to the three other people reading this.

My strategy is unique to my life situation. Yours should be too.

Here’s my plan:

When bitcoin hits $100k, sell 5% of my stack.

As I get older, I care less about what people think of me. I think that is mostly a good thing, but I also suspect that bitcoin twitter will belittle anyone who is selling corn at $100k. “It is still severely mispriced.” “Why would you sell? This thing is going to $1m.”

Yeah, well you know what? Selling that much of my stack is going to materially improve my quality of life. There is something to be said about compounding good decisions, and while I agree that $100k is just the start of bitcoin’s long-term value, time is scarce. Putting off an awesome family vacation or paying off some debt to wait for bitcoin to moon is a missed opportunity.

The key: sell a small portion of your stack, and have a plan in place to (hopefully) replenish what you’ve sold.

Part of the glidepath mentality for me is that I wholly recognize that once I make the decision to sell some bitcoin, that could represent the high water mark of the amount of bitcoin I will ever own. As the price runs, my recurring purchases may not ever get me back to where I once was. But, as long as I’m selling to improve my life, I’m mentally prepared to accept that tradeoff.

Plus, just taking this first step, I get to prove to my wife that yes, I will sell some bitcoin.

Pick a date on the calendar, let’s say December 15, 2025, and sell 5% of my stack.

If previous bull runs are any indication, around this time will be about the time bitcoin peaks for the cycle. (Unless the supercycle theory comes to fruition and the price runs in perpetuity.) I’m not banking on that though and as I am a terrible timer of markets and tend to get emotional even more so in a bullish environment, having a plan in place to lock in what should represent a price near bitcoin’s historical ATH seems like a logical decision.

Having this piece of my playbook in place also allows me to detach emotionally from the asset. If, for whatever reason bitcoin is not trading above $100k at this point, meaning I will not have sold any corn by this date, this gives me the opportunity to sell some bitcoin, have a great Christmas with the kids, and re-evaluate my long-term thesis of whether or not bitcoin will perform the way I currently expect it to.

As emotionally tied to this asset as is probably apparent, I challenge myself to always question my assumptions and update my outlook based on new information. If bitcoin is no longer doing it’s thing, I’ve gotta take a step back and reflect on that. This is not my base case, but it’s important to be ready for all outcomes.

If bitcoin goes parabolic, consider my options.

This is the fun part. Now I’m not saying I expect bitcoin to rip to $300k, $400k, dare I say $500k this cycle, but I don’t think something like that scenario can be completely ruled out. Folks, the money is broken. We will see these prices for bitcoin at some point. Do we see that by 2025? Obviously, I don’t know.

And yes, again, if bitcoin goes to $300k, does that mean it is on a deterministic path to $1m in the next 4 year cycle? Probably. But the future is unknown and being able to lay a solid financial foundation for me and my family is a worthy tradeoff to me rather than hoarding the maximum amount of bitcoin possible.

The big piece of debt I’d be eyeing to eliminate at $400k bitcoin: the mortgage. It would be silly to pay it off in one fell swoop, as we have an interest rate under 5% and there’s no point in selling more bitcoin at that point than is needed as we’d likely see $1m bitcoin at the next cycle.

An idea came to me this morning though after my 2nd cup of coffee: what if I sold enough bitcoin at $300-500k bitcoin to set aside enough money for 2-3 years of mortgage payments?

I could then put those cuck bucks in a traditional savings account, with the sole purpose of being debited every month for the mortgage. That gives us some breathing room in our budget and allows me to increase my weekly dollar cost average amount in 2026 and 2027, a time where we’re likely to see more bearish prices. They call it “Bitcoin Winter” for a reason. Making sure I’m provisioned for those down years seems like an effective use of bitcoin’s volatility.

So, to sum it up. The playbook is:

Sell 5% at $100k

Sell 5% on December 15, 2025

Sell ~0.1-0.2 BTC if bitcoin reaches $300-$500k this cycle

I don’t have a crystal ball. I am just a guy with three readers of this blog and a growing conviction that bitcoin will be transformative for my financial future.

I plan on using the Bitcoin Glidepath as my personalized guide for using bitcoin as a tool to enhance my life. Having a plan in place will allow me to actually use the tool instead of endlessly hodling, watching life-changing opportunities slip away as bitcoin reverts back to its next cycle low.

These are bullish times, my friends. First order of business is to enjoy the ride. But towards the end of this cycle, when it feels like the price is going to just keep ripping and you can’t believe how rich you are, that could be your sign to take up a similar strategy.

Do yoh use the 4% rule for bitcoin FIRE or Morgen Rochard's 2% rule?

You might consider putting some into Real Estate for cash flow. That is my plan at least. It can help reduce your overall taxes and can be an enduring source of income.

I wrote about this for bitcoiners specifically here: https://bc1984.com/why-bitcoiners-should-invest-in-real-estate/